Cash flow is one of the most vital elements in the financial health of any organization. This multi-measure approach enables you to evaluate role-specific skills, personality traits, aptitude, and cultural add, which all contribute to a person’s success in the role. Using the Accounts Receivable test is a great start, but the best approach involves combining it with other tests to get a holistic, data-driven picture of each candidate. Discover your strongest candidates with TestGorilla’s easy-to-read output reports, rankings, and analytics.

What is your experience with analyzing significant amounts of accounting information?

Both speed and accuracy are integral when taking the accounts receivable assessment test, so remember to read each question carefully while moving quickly within the time limit. They play a critical role in the financial team by managing incoming payments and making sure that all transactions are recorded both accurately and timely. It consists of scenario-based questions that ask candidates to solve common issues when handling accounts receivable. An assessment is the total package of tests and custom questions that you put together to evaluate your candidates. Each individual test within an assessment is designed to test something specific, such as a job skill or language. You can have candidates respond to your custom questions in several ways, such as with a personalized video.

Question 1: How do you Calculate Days Sales Outstanding (DSO)?

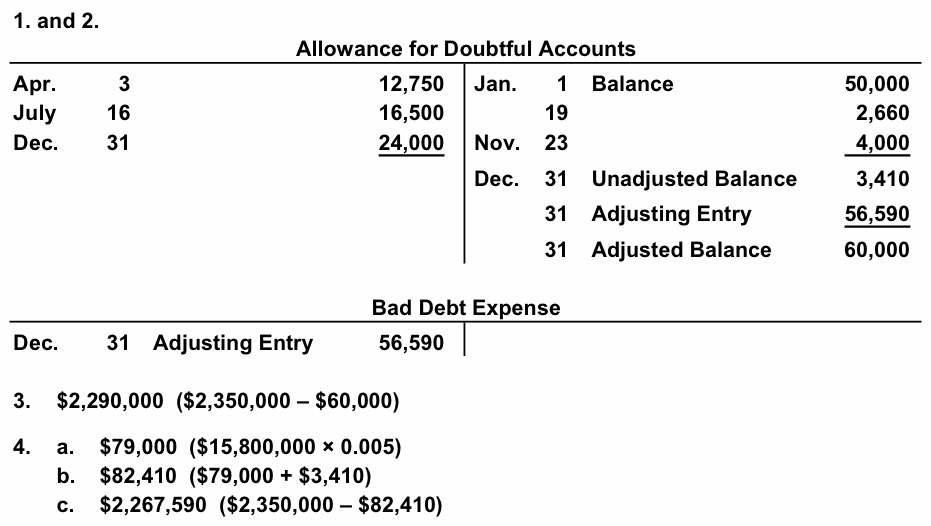

Record all transactions related to accounts receivable for the current year. A. Bad debt expense must be recorded in the period the sale occurs to comply with the matching principle. Recording the expense in a later period when you discover the receivable will not be collected is the direct method and is not in accordance with the matching principle. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- As an AR professional, you’ll frequently interact with customers, colleagues, and other stakeholders.

- Candidates may also mention that accounts receivable ratios measure how frequently an organization converts receivables into cash.

- Optimise your hiring process with HiPeople’s AI assessments and reference checks.

- For instance, I recently asked a question about a Python test I intended to implement.

- If Company C has annual revenue of $3 million and average total assets of 1 dollar million, its asset turnover ratio would be 3.0, meaning it generates 3 dollars for every 1 dollar of assets.

Essential Guide to the Accounts Receivable Skills Test

The Accounts Receivable test evaluates candidates’ skills in identifying, recording, and managing a company’s incoming payments and outstanding invoices. It helps you find skilled accountants who can effectively maintain financial records and ensure accurate tracking of your transactions. Asset turnover ratio helps assess how efficiently a company uses its assets to generate revenue.

Top 50 MongoDB Interview Questions and Answers

They may also mention that bank reconciliation can help enterprises safeguard against fraudulent activity. If they haven’t used your software, they should show that they are willing to learn. Make sure to utilize the guide above as a roadmap for successful preparation and practice leading whom may i claim as a dependent up to test day. You should be able to get high marks and prove to the employer that you are the best candidate for the position if you focus, practice, and prepare. Send email invites directly from TestGorilla, straight from your ATS, or connect with candidates by sharing a direct link.

Analyzing Balance Sheets

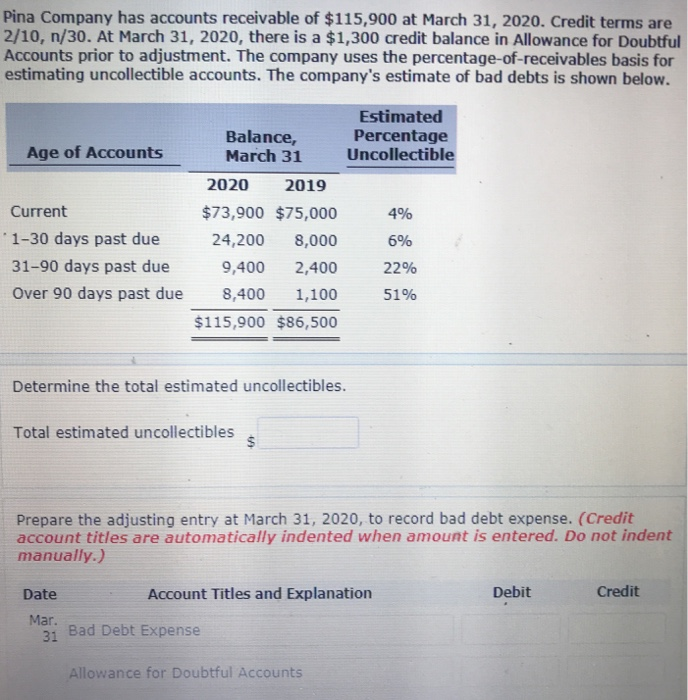

The company uses the % of accounts receivable method to record bad debt expense at the end of the year. For talent acquisition professionals and hiring managers, this guide serves as a valuable resource to assess candidates effectively. With your risk assessment and credit management skills showcased, it’s crucial to demonstrate your knowledge of compliance and legal considerations in the AR domain. An AR interview typically consists of various stages designed to assess your technical knowledge, problem-solving abilities, communication skills, and cultural fit within the organization. These stages may include phone screenings, face-to-face interviews, behavioral assessments, case studies, and sometimes even role-playing scenarios. Each phase presents unique challenges, and we’ll guide you through the entire process to ensure you shine at every step.

For conservative investors, a lower debt-to-equity ratio, perhaps below 1.0, is generally preferable, depending on industry standards. Ask all candidates the same accounts receivable interview questions to minimize bias. Decide on a comprehensive list of questions and ask them in the same order to enhance the fairness of your interview. Your candidates may explain that they use accounts receivable aging reports to find out which clients are behind with their payments and determine whether they are worthy of credit. Here are seven general accounts receivable interview questions to ask candidates at the beginning of the interview.

Aspiring leaders should showcase their ability to motivate and resolve conflicts within their AR teams, while also demonstrating resilience in handling stressful situations. Throughout the interview process, candidates are encouraged to provide well-crafted, concise, and structured responses that highlight their skills and experiences. Let’s delve into the critical aspects of risk assessment and credit management in the Accounts Receivable process. Demonstrating your proficiency in these areas will showcase your ability to safeguard the company’s financial interests. With your problem-solving and analytical skills on display, let’s explore the vital role of risk assessment and credit management in the AR domain.